Employment Termination And 401k

IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. If your withdrawal is from a SIMPLE IRA plan within two years of your first participation in the plan the additional early distribution tax is 25.

Termination Letter How To Write Templates Examples

Disbursement help free help.

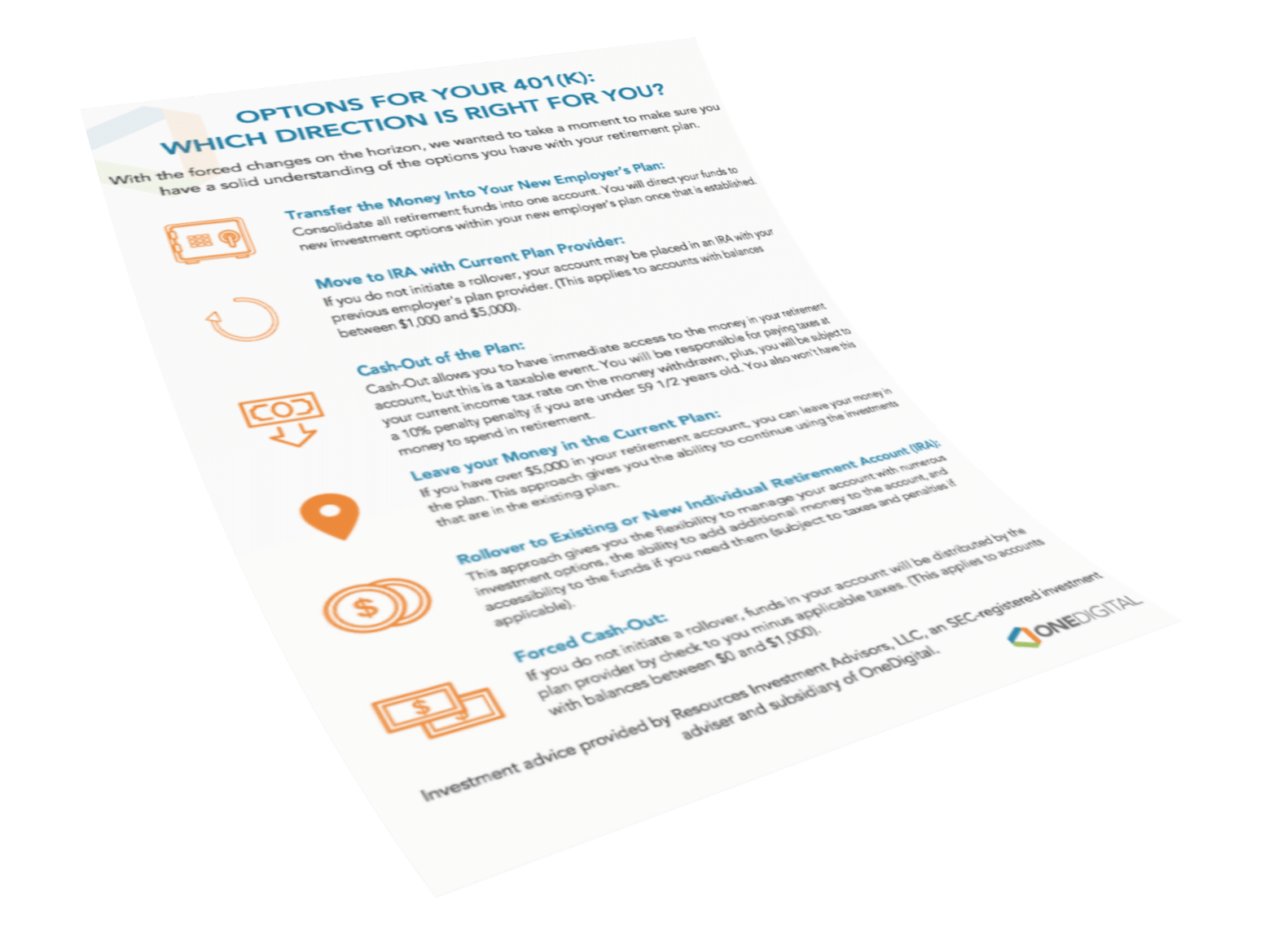

Employment termination and 401k. However taking a significant distribution could put you into a higher tax bracket. By leaving your funds in a former employers 401k plan you are restricting your investment choices. You have four basic options for handling your 401 k when you leave your job whether you quit are laid off or are fired.

Thousands of dollars more could be credited to a former employees 401k account because of the partial termination rule. Besides the loss of income many of these individuals also face unexpected and unpleasant tax consequences if they have an outstanding 401 k plan loan. Even if youre allowed to keep your money in the plan you may decide youd rather not have anything else to do with your former employer.

By doing a tax-free rollover of your account into an individual retirement account or IRA you can choose investments that most 401k plans put off limits such as foreign mutual funds. The Coronavirus Aid Relief and Economic Security CARES Act passed on March 27 2020 temporarily suspended the 10 penalty for those impacted by the coronavirus. Leave it with your former employers plan.

One of the many unfortunate effects of the coronavirus pandemic is the number of folks who have lost their jobs. As long as you have the minimum amount required which varies from plan to plan you can leave your money where it is. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

From March 27 2020 until the. May have to pay an additional 10 early distribution tax if you arent at least age 55 59 if from a SEP or SIMPLE IRA plan. At the time your employment terminates you may be tempted to withdraw all of the money in your 401 k account to cover your living expenses while looking for another job.

Most 401k plans limit your investment options to a preselected list of mutual funds plus one or two fixed-return options. If you withdraw some or all of your balance you can still decide to roll it over to a new employers plan or to an IRA within 60 days. Annons Non Resident Alien from the US Retirement Withdrawal 401k US.

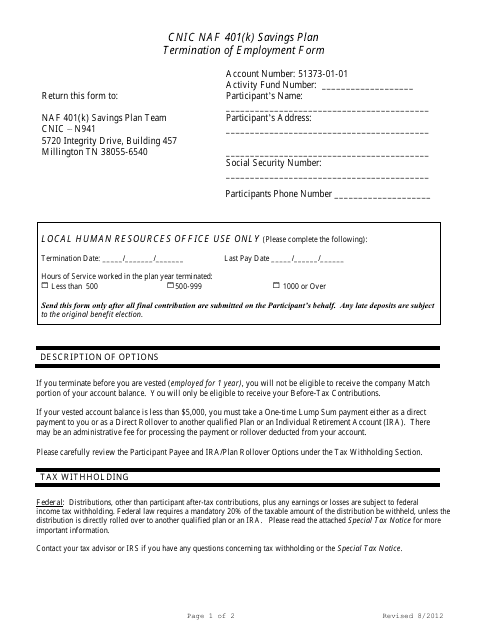

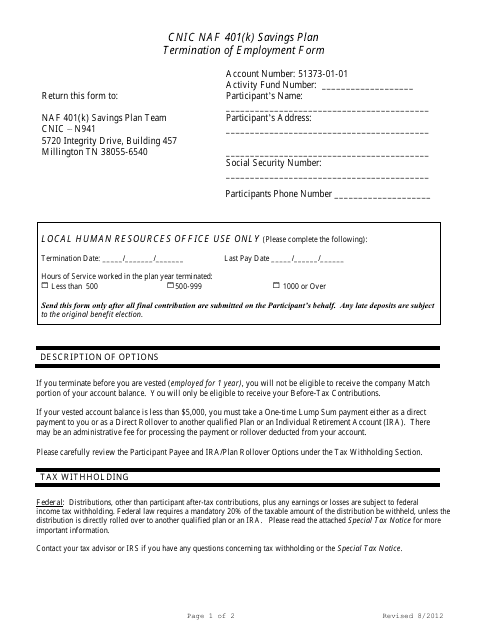

Generally the process of terminating a 401 k plan includes amending the plan document distributing all assets notifying employees filing a final 5500-series form and possibly filing a Form 5310 PDF Application for Determination for Terminating Plan to ask the IRS to make a determination on the plans qualification status at the plan termination date. 401 k Payout After Termination Your ex-employer may require you to take a 401 k payout after termination especially if the balance in your account is less than 5000. Annons Non Resident Alien from the US Retirement Withdrawal 401k US.

This means that you will need to continue matching or making contributions including deferrals employer contributions and loan payments as outlined in your plan to your employee 401. Disbursement help free help. Annons Get Instant Access to All Templates You Need to Start Run Grow Your Business.

Whatever amount you withdraw from the 401k will be taxed at ordinary income rates and if you are under the age of 59 12 you will also have to pay a 10 percent early withdrawal penalty. You are legally responsible for following the guidelines of your 401 k plan up to the date of the termination. Workers who leave their company when they reach that age are subject to different withdrawal.

Annons Get Instant Access to All Templates You Need to Start Run Grow Your Business. If you leave your job whether voluntarily or involuntarily with an unpaid loan balance your former employer may allow. If you get terminated from your job you have the ability to cash out the money in your 401 k even if you havent reached 59 12 years of age.

And if you are under age 55 when you leave the job youll pay a 10 early withdrawal penalty. If your employment termination arises from retirement you can simply take a distribution and cash out your 401k.

No Simple Task Terminating A Retirement Plan The Right Way Ascensus

Massmutual What S In A Name A Retirement Plan Comparison

Employee Termination Letter Form Pros

Https Www Proskauer Com Uploads Considerations For Terminating A 401k Or Profit Sharing Plan

35 Perfect Termination Letter Samples Lease Employee Contract

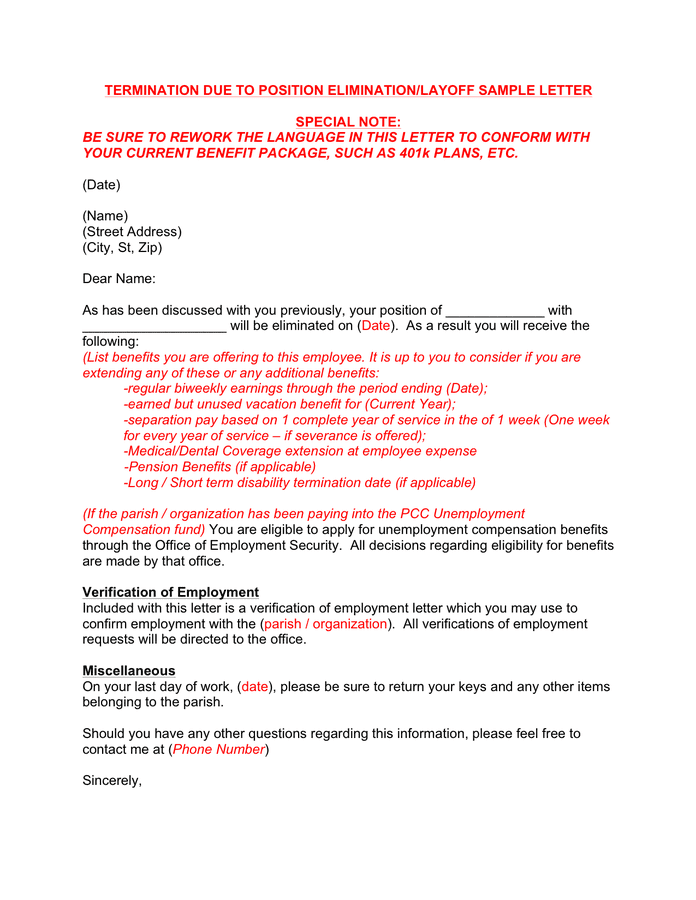

Termination Due To Position Elimination Layoff Letter Sample In Word And Pdf Formats

Employment Termination Letter Template Approveme Free Contract Templates

401k Forced Out Rules Fisher Investments 401 K Solutions

Sham Termination Of Employment And Distributions Retirement Learning Center

Free 9 Sample Employee Termination Letters In Pdf Ms Word

Https Www Ta Retirement Com Resources Dr Csc As Pdf

Termination Letter How To Write Templates Examples

Can A Departing Employee Make 401 K Contributions From Severance Pay

Cnic Naf 401 K Savings Plan Termination Of Employment Form Download Printable Pdf Templateroller

Free Termination Letter Free To Print Save Download

Adp Termination Form Fill Online Printable Fillable Blank Pdffiller

Terminating Your Retirement Plan What You Need To Do And How To Tell Your Employees Onedigital

What To Do With Terminated Employees In Your 401 K Plan Acm 401k

Post a Comment for "Employment Termination And 401k"