Employment Termination Payment Tax Rate

How Is Severance Pay Taxed. This alongside the new PENP rules means termination payments have become both more complex and more expensive for employers.

Https Www Mlc Com Au Content Dam Mlcsecure Adviser Technical Pdf Guide To Etps And Redundancy Pdf

Employers must consider the new rules if they make any payments or provide any benefits on termination of employment that arent fully liable to tax and NIC.

Employment termination payment tax rate. Special tax rates for severance payments Special tax rates based on the retirement lump sum tax table apply specifically to severance payments made to an employee. Payment in lieu of notice However if your contract of employment provides for a payment of this kind on termination of the contract these tax-free entitlements do. Employers pay Social Security tax of 62.

Use the employees existing tax code on a week 1 or month 1 basis until you receive a new code from HMRC or on a cumulative basis if the first pension payment is in the new tax year. A non-statutory redundancy payment that is the amount paid by your employer which is over and above the statutory redundancy payment. An employer is required to issue a separate PAYG Payment Summary employment termination payment where they have terminated an employees employment and paid an ETP.

The income tax treatment of Payments In Lieu Of Notice PILON appears to be causing the majority of the on-going issues. Involuntary termination the portion of the proceeds that is for lost wages ie severance pay back pay front pay is taxable wages and subject to the social security wage base and social security and Medicare tax rates in effect in the year paid. These proceeds are subject to employment tax withholding by the payor and should be reported.

This is also known as an ex-gratia payment. Does this apply retrospectively. This guide sets out the tax treatment of some of the more common payments made on termination of employment.

Employment termination payment tax rate. As a result Sonyas ETP amount of 50000 will not receive concessional tax rates and withholding will be at the top marginal rate 49. 20 10 for Quebec on amounts over 5000 up to and including 15000.

Currently the first R500 000 is not subject to tax the next R200 000 is taxed at 18 the subsequent R350 000 is taxed at 27 and all amounts above R1 050 000 are taxed at 36. These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions. If the employee takes voluntary redundancy for example by submitting a resignation letter to the employer or by signing a mutual agreement on voluntary redundancy the employee is not eligible for a tax exemption for the severance pay or any other payment received due to termination under Clause 2 51 of MR No.

The IRS treats severance pay as supplemental wages because it is not a payment for services in the current payroll period but a payment made upon or after termination of employment for an employment relationship that has terminated even though paid for a fixed 51 weeks. In general employees and employers both pay a 62 Social Security tax and a 145 Medicare tax on a persons wages. The Court ruled that severance is subject to tax under the Federal Insurance Contributions Act tax.

It is worth noting that in April 2020 a new employers NIC charge at 138 was introduced on the excess of termination payments over the 30000 exemption. Reporting of an ETP. And while a retirement fund lump sum withdrawal benefit also qualifies for.

Taxation of Termination Payments from 6 April 2018 Key developments 30000 tax-free threshold retained New concept of post-employment notice pay introduced which will be taxable and will not benefit from 30000 tax-free threshold Employers class 1 National Insurance payable on all taxable payments made in connection. State law does not allow for a reduction in employer rates. These taxes are known as FICA payroll or employment taxes.

FICA consists of Social Security tax and Medicare tax. Balance eligible for termination related tax exemptions. Section 207049 2 defines severance pay as dismissal or separation income paid on termination of employment in addition to the employees usual earnings from the employer at the time of termination The term does not include any payment made to settle a claim or lawsuit or in connection with a previously negotiated contract.

However you do not have to tax any statutory redundancy payments and these can still be paid tax-free even where there is a PENP liability. An employee upon termination of employment will qualify for a once-off R500000 tax exemption while the amounts in excess of R500000 will be taxed at lower rates than provided for in the normal SARS tables. PENP only applies to payments made on or after 6 April 2018 where termination of employment also occurred on or after 6 April 2018.

Unfortunately severance pay is taxable. The government is intending that from April 2019 termination payments that are subject to income tax on amounts in excess of 30000 will become subject to employer national insurance contributions.

Lump Sum E Payment Tax Offset 2021 Atotaxrates Info

Https Www Health Qld Gov Au Data Assets Pdf File 0033 398913 Qh Imp 267 1 16 Pdf

A Guide To Employment Termination Payments Etp

Processing Employment Termination Payments Type R Type O Payroll Support Au

Processing Employment Termination Payments Type R Type O Payroll Support Au

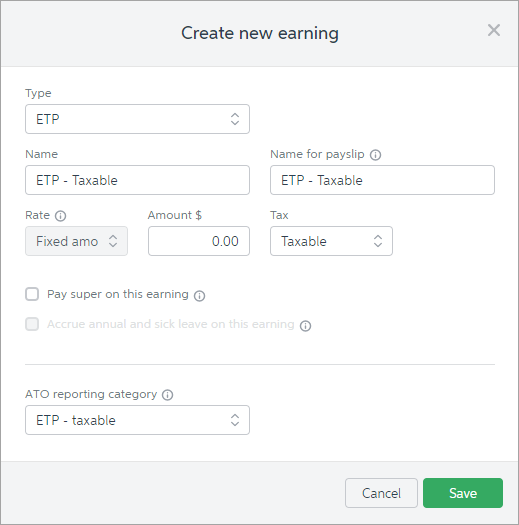

Processing An Employment Termination Payment Etp Myob Essentials Accounting Myob Help Centre

Processing Employment Termination Payments Type S And Type P Payroll Support Au

Title Tax Rules On Redundancy Or Employment Termination Payments

Processing An Employment Termination Payment Etp Myob Essentials Accounting Myob Help Centre

Processing Employment Termination Payments Type S And Type P Payroll Support Au

Title Tax Rules On Redundancy Or Employment Termination Payments

Assign Ato Reporting Categories For Single Touch Payroll Reporting Myob Accountright Myob Help Centre

Processing An Employment Termination Payment Etp Myob Essentials Accounting Myob Help Centre

Calculating Etp Tax Withholding Rates As Part Of Final Pay

Https Www Plum Com Au Content Dam Plum Pdf Forms 20and 20publications Psf Redundancy Factsheet Pdf

Processing Employment Termination Payments Type R Type O Payroll Support Au

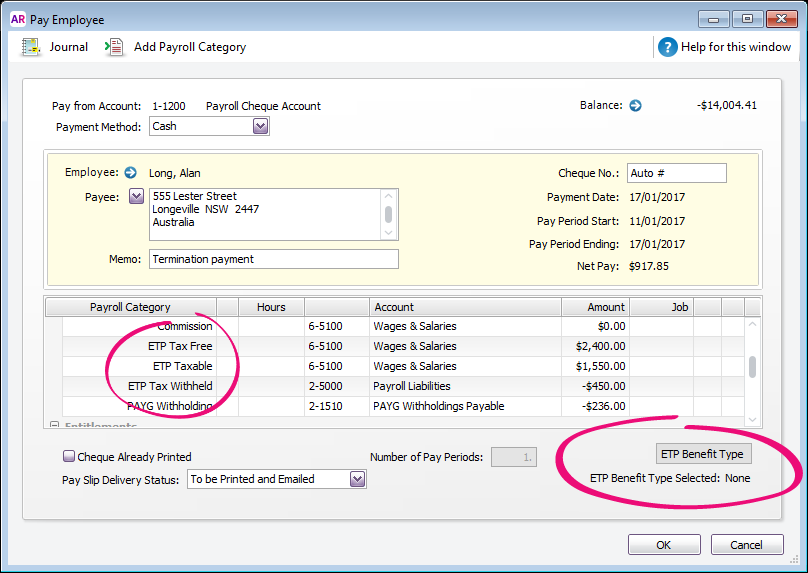

5 Record The Final Termination Pay Myob Accountright Myob Help Centre

5 Record The Final Termination Pay Myob Accountright Myob Help Centre

Post a Comment for "Employment Termination Payment Tax Rate"