Unemployment Tax Refund More Than Expected

Because of the ongoing coronavirus pandemic and staff shortages the agency has reported that it still has more than. Your IRS Refund Could Be Bigger Than Expected These potentially generous payments are from the waiving of federal tax on up to 10200 of unemployment.

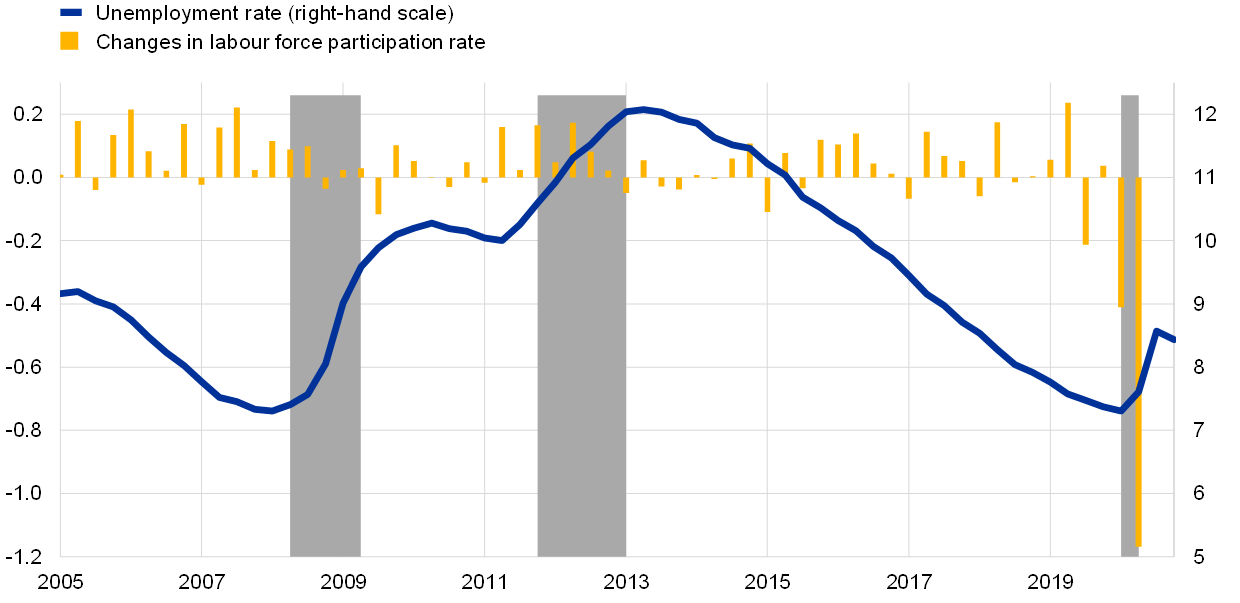

The Impact Of The Covid 19 Pandemic On The Euro Area Labour Market

Payment schedule transcripts and more.

Unemployment tax refund more than expected. The IRS gets ahead of. Oh Heck Yes Sir. If your modified adjusted income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid to you in 2020.

IRS unemployment tax refund status. The 10200 per person exclusion applies to taxpayers single or married filing jointly with modified adjusted gross income of less than 150000. The form should detail how much unemployment was received and how much if any was taken out for taxes.

Payment schedule transcripts and more. So far the IRS has gone through four rounds of refunds due to the unemployment compensation exclusion. The IRS has sent 87 million unemployment compensation refunds so far.

IRS Is Sending More Unemployment Tax Refund Checks This Summer Uncle Sam has already sent tax refunds to millions of Americans who are eligible for the 10200 unemployment compensation tax exemption. More than 87 million unemployment compensation refunds have been issued by the IRS totaling more than 10 billion as per MARCA. 764 - Earned Income Credit -32900.

846 - Refund Issued is 45947. Unemployment compensation is taxable income. Angela LangCNET Many families are still waiting on the refund check for taxes they paid on their unemployment benefits.

4M to Receive Refunds Under Jobless Benefit Tax Break. 766 - Credit to your account -12600. The American Rescue Plan excludes 10200 in 2020 unemployment compensation from income used to calculate the amount of taxes owed.

Taking more time for 2020 tax returns. IR-2021-159 July 28 2021 The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. More Unemployment Tax Refunds Expected to Head Out This Month.

Taxpayers who submitted their taxes before March 20 2021 are now entitled to an adjustment and perhaps a refund. Direct deposit refunds will begin July 14 and paper check refunds will begin July 16 the IRS said Tuesday. Saying this because the refund I received has cents amount too 431189.

One piece of good news is that the tax agency just issued another round of refunds for tax overpayment on unemployment. So far the IRS has issued nearly 9 million unemployment compensation refunds totaling more than 10 billion. My Federal refund amount was 3 more than expected Could it be that TurboTax rounds numbers down and IRS actually used the correct numbers without rounding.

For married taxpayers you and your spouse can each exclude up to 10200. Know that the Internal Revenue Service recently announced that tax refunds on 2020 unemployment benefits part of President Joe Bidens 19 trillion American Rescue Plan are expected to start. The IRS says that you can expect a delay if you mailed a paper tax return.

Current refund estimates suggest. The tax break is only for those who earned less than 150000 in adjusted gross incomeand for unemployment insurance received during the pandemic in 2020. More the IRS says are on the way.

806 W-2 or 1099 withholding 2082 based on job that was let go in April COVID Federal Tax for Unemployment its correct. IRS Account Statement Details Below. IRS unemployment tax refund update.

About 4 million more people who overpaid their unemployment insurance taxes than they received last year are expected to get a refund from the IRS soon. The 10200 is the amount of income. The IRS says it will send 2020 unemployment refunds through the end of summer.

The average refund is 1265.

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois States

Pin By George Dearing On Real Estate And Housing Trends House Prices Renting A House Real Estate News

The Irs Announced That It Is Lowering From 85 To 80 The Amount Taxpayers Are Required To Have Paid In Order To Escape An Un Tax Refund Irs Federal Income Tax

Status Not Available Irs Says These Taxpayers Won T Receive Second Stimulus Check Automatically In 2021 Irs Irs Website Tax Credits

Why Should I Submit A Tax Return In Germany

The Impact Of The Covid 19 Pandemic On The Euro Area Labour Market

Helping Entrepreneurial People Make Consistently Smart Financial Decisions Financial Decisions Financial Investing

Analysis It S Not A Labor Shortage It S A Great Reassessment Of Work In America In 2021 Job Analysis Things To Think About

Real Estate Fintech Corelogic Receives Multiple Potential Bids At More Than 80 A Share Sources Say Real Estate Fintech Estates

Tax Return In Germany In English For Foreigners Read This Before Doing It

Reminder Iphone Homes Money Affordable Tips Real Estate Trends Real Estate Companies Real Estate

How Students Are Spending Their Loans Infographic E Learning Infographics Student Loans Student Loan Debt Money Smart Week

Annual German Tax Return Einkommensteuererklarung

Average Home Prices Back To Late 2003 Levels S Dow Jones Reported Today That Both Its 10 City And 20 City Case Shiller Compo House Prices Chart Housing Market

Three Month Lme Aluminium Fell By 1 04 Per Cent To End At Us 1759 5 Per Tonne On Friday As The Dollar Index Strengthened Open Inte Aluminium Price Rebounding

Koolearn Has New Oriental S Brand Advantage As Koolearn S Chinese Name Is New Oriental Online Koolearn H After School Tutoring Student Growth Revenue Growth

Post a Comment for "Unemployment Tax Refund More Than Expected"