Employment Tax Rates 2020

New and Used Equipment and. KES 2400100 per month.

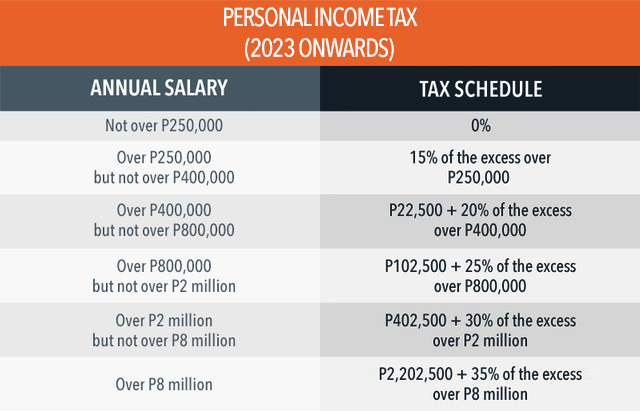

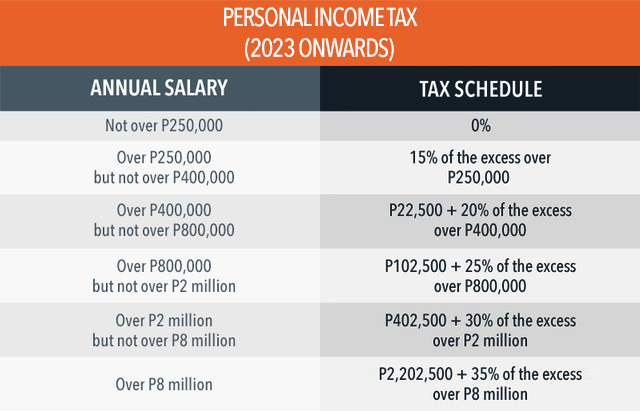

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

Therefore FICA can range between 153 and 162.

Employment tax rates 2020. Interest from a bank account or investment. You must deposit and report your employment taxes on time. Go to Income tax rates Revenu Qubec Web site.

For employees earning more than 200000 the Medicare tax rate goes up by an additional 09. Medicare tax on net investment income 200000 single filers 250000 joint filers 38. Description 2019 2020 Increase Social Security tax rate for employees 620 620 -0-Social Security tax rate for employers 620 620 -0-Social Security wage base 13290000 13770000 480000 Maximum Social Security tax for employees 823980 853740 29760 Medicare tax rate for employers 145 145 -0-Medicare tax rate for employees.

Others like Alaska Florida Nevada South Dakota Texas Washington and Wyoming dont. For Social Security the tax rate is 620 for both employers and employees. Scottish starter tax rate.

240 per week 1042 per month 12500 per year. Thats because of the Social Security wage base. Contribution of eg benefit entitled persons self employ low contribution 545.

For 2021 the Social Security wage base is 142800. Since youre paying both portions for employer and employee of Social Security and Medicare the rate breaks down as follows. Income tax rates are the percentages of tax that you must pay.

Calculate Your Employment Taxes. On the next 1666667. However the Social Security portion may only apply to a part of your income.

Please note that several tax rebates heffingskortingen may apply. A Work and Income benefit. PAYE tax rates and thresholds 2020 to 2021.

For Medicare the rate remains unchanged at 145 for both employers and employees. TAX RATES Chargeable Income From To Rate Subtract Single Rates. For 2020 the self-employment tax rate is 153 on the first 137700 worth of net income plus 29 on net income over 137700.

Some states have an income tax. English and Northern Irish basic tax rate. State Payroll Tax Rates.

240 per week 1042 per month 12500 per year. On the next 1666667. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare.

You also must report on the taxes you deposit as well as report wages tips and other compensation paid to an employee. 505 on the first 45142 of taxable income 915 on the next 45145 1116 on the next 59713 1216 on the next 70000 1316 on the amount over 220000. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

The two states that tax investment income but do not assess personal income taxes. PAYE tax rates and thresholds 2019 to 2020. Depositing and Reporting Employment Taxes.

Employment Tax Due Dates. Money from renting out property. See the table below for the applicable rates.

Cap on equipment purchases. KES 240000 per month. The rates are based on your total income for the tax year.

Your income could include. Additional Medicare Tax for income above 200000 single filers or 250000 joint filers 09. You must deposit federal income tax withheld and both the employer and employee social security and Medicare taxes.

Medicare Tax Rate. 19 on annual earnings above the PAYE tax. They lower the tax and premium payable.

These tax rebates have been increased for 2020. Employer contribution high contribution 670. Maximum Social Security tax withheld from wages is 853740 in 2020.

The self-employment tax rate is 153. The rate consists of two parts. 108 on the first 33723 of taxable income 1275 on the next 39162 174 on the amount over 72885.

Remaining amount over 5733333.

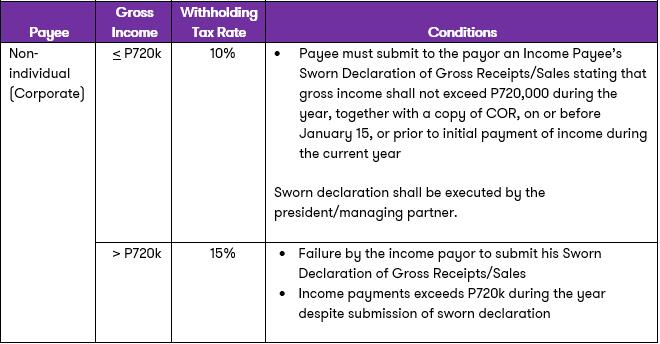

Revised Withholding Tax Table Bureau Of Internal Revenue

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

Income Tax Rates For Individual For Ay 2021 22 Old Vs New

2019 20 Tax Rates And Allowances Boox

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

Payroll Tax What It Is How To Calculate It Bench Accounting

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Revised Withholding Tax Table For Compensation Tax Table Withholding Tax Table Tax

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Calculator Philippines 2021

Tax Calculator Compute Your New Income Tax

Post a Comment for "Employment Tax Rates 2020"