Employment Tax Validation Function

12 May 2020 Employment Taxes Validation ETV From the 2020 year of assessment SARS is performing tax calculations on the IRP5IT3a certificates. Federal employment taxes consist of five separate employment taxes items a through e.

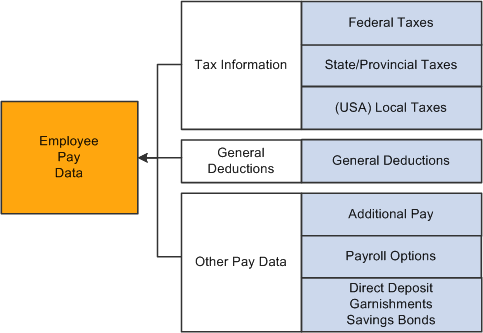

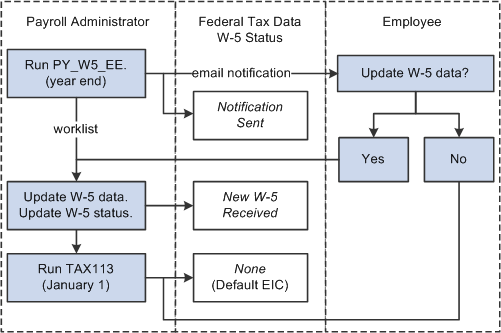

Peoplesoft Payroll For North America 9 1 Peoplebook

All the certificates submitted were accepted and processed and will be pre-populated on the employees income tax return ITR12.

Employment tax validation function. From decisioning to collections this valuable information can be utilized to significantly improve analytics. We value education here in Wyoming but dont plan on us to provide it as we wont tax ourselves. 4232 Employment Tax Responsibilities and Coordination with Other Functions.

28 rows Employment Taxes Validation ETV Obligation to deduct correct amount of PAYE every month Employers are obligated to deduct the correct amount of employees tax PAYE from an employees remuneration and to declare and pay such amount to SARS on a monthly basis. The business mileage rate for 2021 is 56 cents per mile. You may use this Web site and our voice response system 18005553453 interchangeably to make payments.

322 employment taxes validation 76 323 managing payroll file imports in esyfile employer 79. Many employers outsource some or all of their payroll and related tax duties to third parties. 3 introducing the additions to the menu and functions for esyfile employer 17 31 database encryption and decryption 17 32 database split by paye reference number 18.

Filing taxes is one of the most important things that people need to do in the New Year. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows. We help you understand and comply with your employer taxation obligations and to prepare for tax authority reviews.

2On the Data Validation login screen enter your User Name. City of Sheridan 4101 S Federal Boulevard Sheridan CO 80110-5399 Phone. The Internal Revenue Service wants employers to understand their options when it comes to choosing payroll service providers.

FS-2020-12 August 2020. We help you validate your internal processes to control risks and costs and - if compliance failures occur - we work with you on remediation and can negotiate with tax. Where it is found that the incorrect amount of tax was deducted from the employee a letter will be issued accompanied by a file containing a list of the certificates that have failed the SARS calculation.

As a quick reminder folks who work for themselves need to pay both income tax and self-employment tax because a sole-proprietor is both the employer and the employee so get taxed from both ends. Employers must deposit and report employment taxesSee the Employment Tax Due Dates page for specific forms and due dates. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee.

A determination of employment tax liabilities requires finding that there is an employer an employee and a payment of wages or compensation. At the end of the year you must prepare and file Form W-2 Wage and Tax Statement to report wages tips and other compensation paid to an employee. These designs vary in terms of time lapse and the employment status of the individuals involved in the study.

The purpose of the Payroll Tax Validation letter is to inform the employer of discrepancies on the amount of tax or levies that were deducted for employees. Use Form W-3 Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social Security Administration. If you are required to make deposits electronically but do not wish to use the EFTPS.

Types of Criterion Validation Studies. This time however it will be even more important because of the stimulus checks. Employers are responsible for withholding and paying employment taxes and filing required returns.

This subsection will also discuss the income tax on self-employment income item f. However both predictive and concurrent validation studies aim at finding a correlati on. Social Security and Medicare which together take about 153 percent of your earnings.

Locating the Flagged Certificates. This data is used to gain a deeper understanding of a customers risk whether salaried contractor or gig type employee. See Cents-Per-Mile Rule in section 3.

1Go to your state Unemployment Insurance Applications Menu screen select Data Validation and then select Validation Software. What is self-employment tax. Criterion validation studies can adopt either a predictive or a concurrent validation study design.

Employment Validation is a suite of real-time employee verification services with data sets derived from the source to provide income employer and work history information. Self-employment tax SE tax has two parts. Community colleges and trade schools hinders those seeking new areas of employment.

We wont go to great lengths to solve educational problems Younger citizens need places to play. Purpose 1 This transmits a revision to IRM 4232 Employment Tax - Employment Tax Examination Objectives renamed Employment Tax Responsibilities and Coordination with Other Functions. Considering this the IRS has come up with a press release1 to help people file2 their 2020 taxes especially those who didnt get coronavirus stimulus checks or got.

To log on to the data validation software follow the next steps.

Understanding Tax Withholding For Remote Employees A Complete Guide Cic Plus

Business 50 Employees Lifecycle Solution By Zing Hr Hrms Hr Management Business

Tips On Proving Income When Self Employed

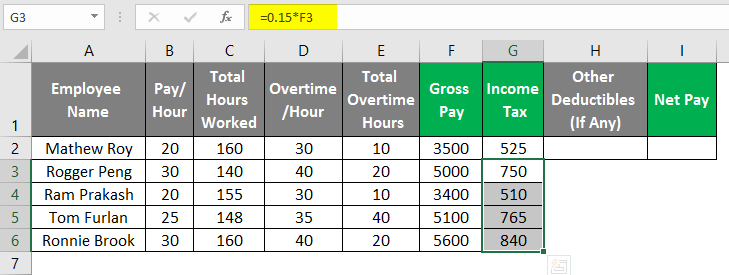

Payroll In Excel How To Create Payroll In Excel With Steps

Payroll Tax Q Series Robust Tax Engine Vertex Inc

Peoplesoft Payroll For North America 9 1 Peoplebook

3 12 154 Unemployment Tax Returns Internal Revenue Service

Peoplesoft Payroll For North America 9 1 Peoplebook

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

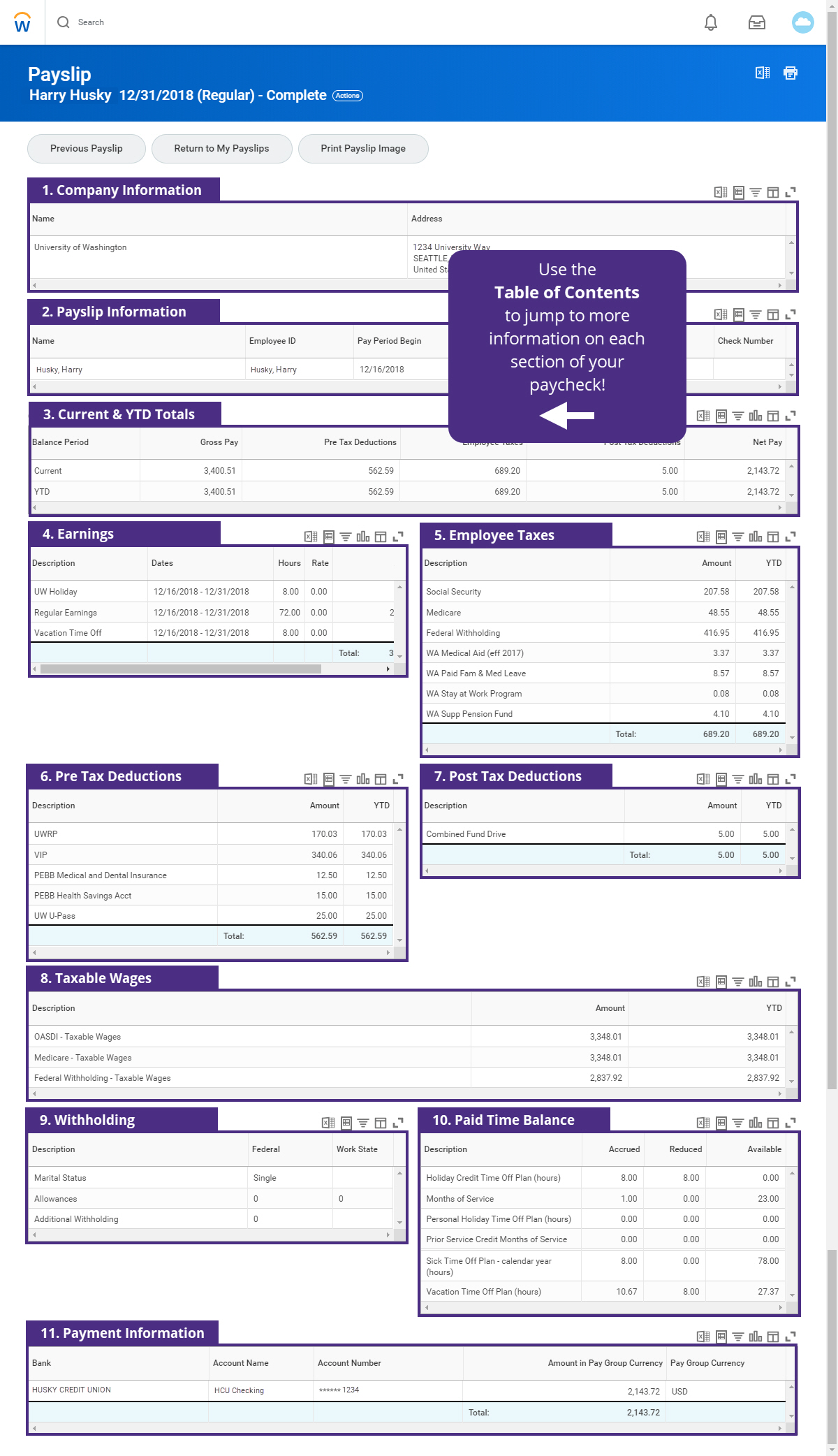

How To Read Your Payslip Integrated Service Center

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Deadline For Itr Filing Extended To August 31st Https Track Keithjonescpa Com 9d94cc10 Taxmaster Taxlaw Bookkeeping Businesstaxes Tax Day Finance August

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Tax Forms Job Application Form

Hiring Remote Workers In The Philippines A Guide For Us Employers

Can My Employer Withhold My W 2 Form

What Are Payroll Liabilities Definition How To Track Them More

Understanding Tax Withholding For Remote Employees A Complete Guide Cic Plus

Post a Comment for "Employment Tax Validation Function"