Unemployment Tax Refund Married

If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your end. Amounts over 10200 for each individual are still taxable.

Unemployment Tax Refunds Irs Says Millions Will Receive One Mahoning Matters

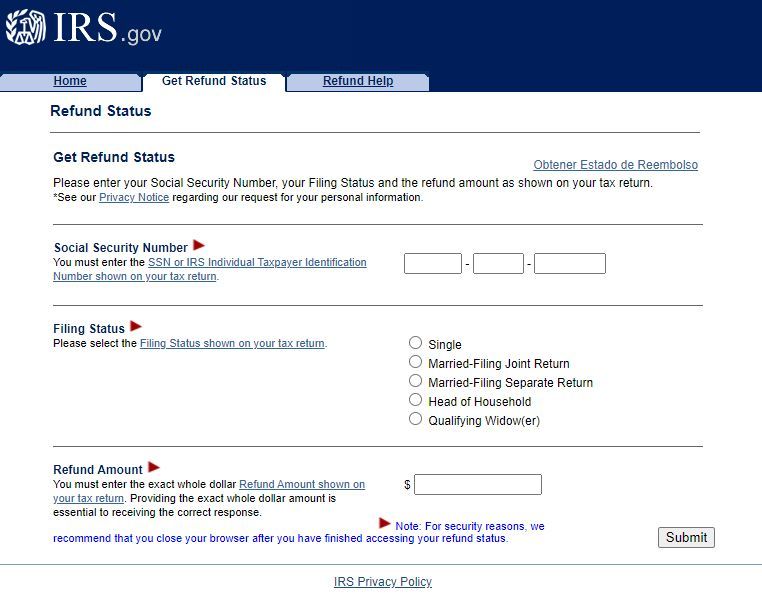

UI unemployment showed up on IRS Transcript on July 28 with a mailing date of July 30.

Unemployment tax refund married. The exclusion applied to individuals and married couples whose modified adjusted gross income was less than 150000. However states may individually decide how to address the issue. The American Rescue Plan made the first 10200 of 2020 jobless benefits nontaxable income or 20400 for married.

This amount doubles for married couples and makes the first 20400 of unemployment compensation non-taxable. For married couples the exemption would reach up to 20400. Paper check refunds start in early August.

Stimulus Unemployment PPP SBA. This is the fourth round of refunds related to the unemployment compensation exclusion provision. As a very small business and individual accountant and tax return preparer for over 25 years CPA for almost all of those Ive been lurking this sub for a number of months now.

So how exactly does the unemployment refund work. The exclusion was limited to individuals and married couples with modified gross income less than 150000. Married couples who file a joint tax return must wait longer than others to get a refund on their unemployment benefits.

The tax refund exemption is intended for individual taxpayers who made less than 150000. Refunds by direct deposit started in late July. Informed Delivery August 1.

The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 20400 for married couples filing. Single filers first then married couples The first batch of tax refunds went out to single people without dependents whose tax returns are the simplest. The American Rescue Plan made the first 10200 of 2020 jobless benefits nontaxable income or 20400 for married couples filing jointly.

Thats where you will see it first. If your modified AGI is 150000 or more you cant exclude any unemployment compensation. Not everyone will receive a refund.

The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support. The IRS has now considered the first 10200 of unemployment compensation received in 2020 as non-taxable. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

The dynamic is largely due to the complexity of calculating their refund. Unemployment refund married filling joint. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

For individuals that amount goes up to 10200. So far the IRS has gone through four rounds of refunds due to the unemployment compensation exclusion. If its not in your IRSgov 2020 account transcript it has not been processed yet.

The IRS said that married couples and. The refunds are coming as a tax break for 2020 unemployment compensation under the American Rescue Plan which excluded the first 10200 of 2020 unemployment benefits --. After seeing post after post maligning the IRS I felt.

The IRS Has Good News These particular refunds are due to President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on up to 10200 of unemployment. But how exactly does the unemployment refund work. Married couple no dependents filed in March.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. Check in hand August 4.

The exclusion only applies to federal taxes.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs About 1 5 Million Get Unemployment Compensation Refunds Mahoning Matters

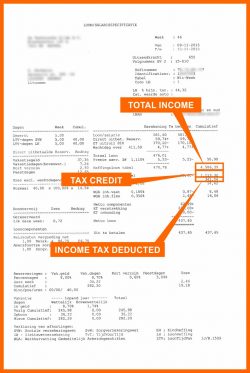

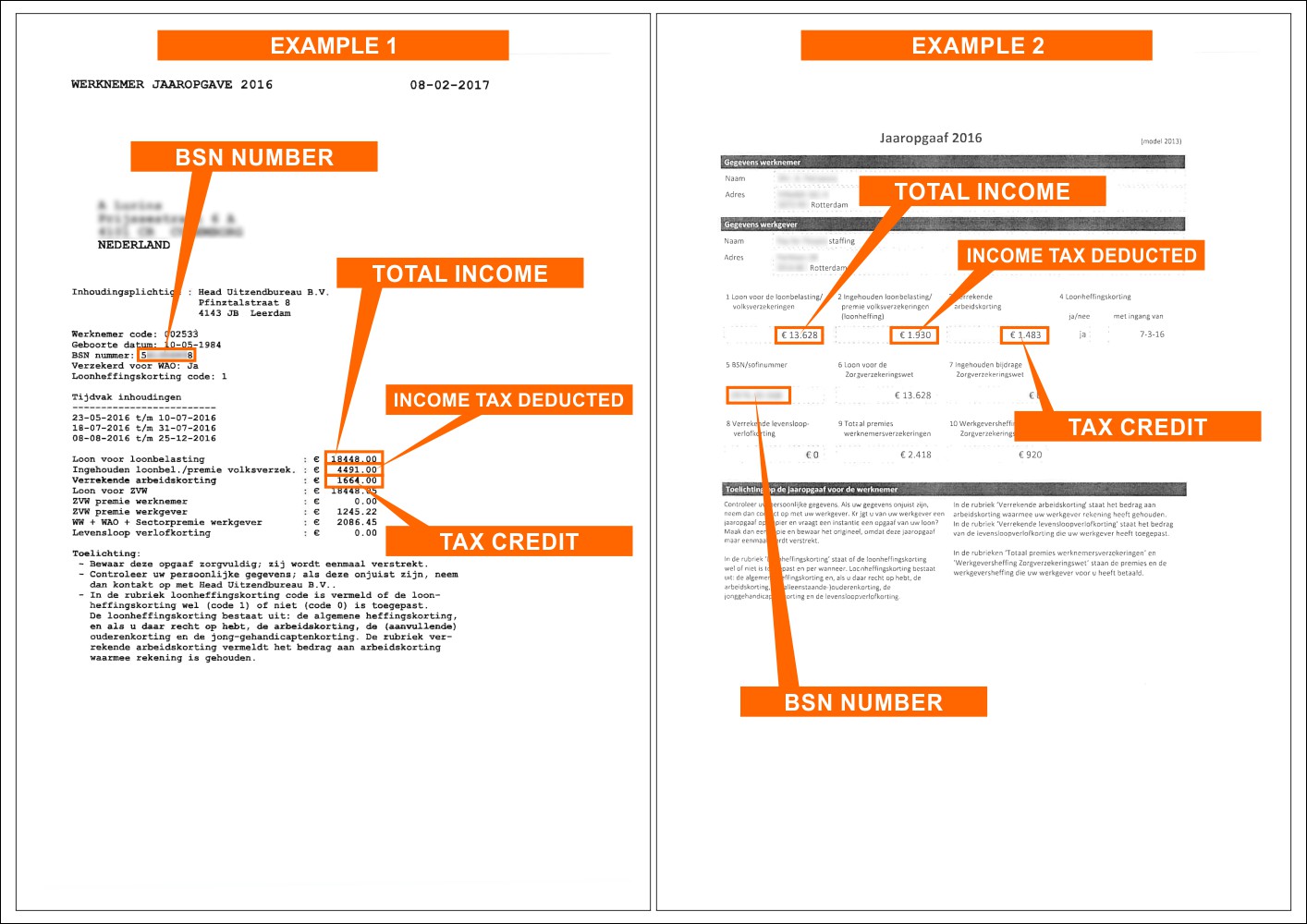

Quick Tax Refund If You Worked In Netherlands Rt Tax

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia New Jersey Business Industry Association

Irs Tax Refund How To Track It Marca

Tax Refund Update Eyewitness News

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Quick Tax Refund If You Worked In Netherlands Rt Tax

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Wusa9 Com

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Quick Tax Refund If You Worked In Netherlands Rt Tax

Quick Tax Refund If You Worked In Netherlands Rt Tax

Income Tax Checklist What Your Accountant Needs To File Your Income Taxes Copy Tax Checklist Income Tax Income

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Unemployment Tax Refund Update Payment Schedule Transcripts And More Cnet

Post a Comment for "Unemployment Tax Refund Married"